Biblical financial planning (also known as Christian financial planning) has been around for some time, but does it really make a difference? This post will look at what Biblical financial planning is, how it differs from traditional financial planning, a few areas to watch out for and how to apply it to your life. As you consider your stewardship responsibility, I hope this challenges your thinking.

What is Financial Planning?

Modern financial planning started in the late 1960’s, but over the last 10 years or so has become more of a focus for financial advisors and the investing public.

Financial planning is the process of examining the entire picture of a person’s finances, establishing goals and then aligning their finances in a way to achieve those goals. It utilizes market, tax and regulatory knowledge to help fulfill their goals in the most efficient way possible.

Though the concept sounds simple, it is actually quite complex. Every financial decision in your life, impacts every other decision. This interconnectedness causes one poor decision to potentially have a cascading effect on all your other decisions. Additionally, the myriad of government regulations, tax policy and markets change constantly, requiring periodic adjustments as you move through life.

Many times, people first realize their need for financial planning because they are going through a life transition, such as preparing for retirement. They have an immediate problem and need help. It is a bit like going to the doctor with leg pain. Though your issue is with leg pain, the doctor will still ask many questions about your health history etc and do an exam, because the pain may not be originating with the leg, but the back instead.

When done correctly, financial planning can not only help with the symptom you are seeking help for, but also identify the root problem and other problems you aren’t aware of.

Ongoing financial planning can help a person stay on top of the everchanging regulations, taxes etc, and ensure they are making wise decisions. Some people have the time and ability to keep up with the changes, understand what needs to be done in their particular situation, and go out and do it. However, others don’t, so they hire a financial advisor to help them.

What is Biblical Financial Planning?

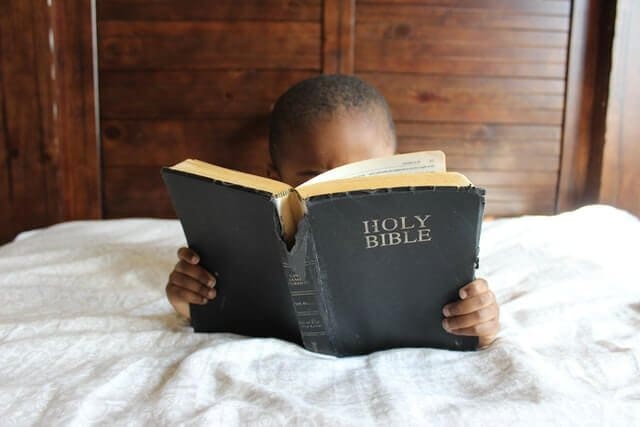

Though financial planning is relatively new, the Bible has been around much longer and has a great deal to say about finances. In fact, the Bible has over 2,350 verses that deal with money, making it the second most discussed topic. Since it has a lot to say on the topic, it should be important for Christians to consider as they make financial decisions.

Jesus said in Matthew 6:21 “For where your treasure is, there your heart will be also.” How we handle money is a direct reflection of our heart’s view of God. Either money will become the focus of our lives and draw us away from God, or we will use it as a tool to honor God.

Biblical financial planning utilizes Biblical principles and wisdom to help people make wise God honoring financial decisions. In essence, it does everything that traditional financial planning does, but uses Bible wisdom as a filter through which to view those decisions.

Traditional vs Biblical Financial Planning

The interesting thing about traditional financial planning is that it actually relies heavily on Biblical principles. After all, the Bible came first and provides great wisdom on finances and wealth.

Here are a few common principles you may have heard about, that are mentioned in the Bible:

- Spend less than you earn – Proverbs 13:11 “Wealth gained hastily will dwindle, but whoever gathers little by little will increase it”

- Establish an emergency fund – Proverbs 21:20 “Precious treasure and oil are in a wise man’s dwelling, but a foolish man devours it”

- Diversify – Ecclesiastes 11:2 “Give a portion to seven, or even to eight, for you know not what disaster may happen on earth”

- Market timing is not beneficial – Ecclesiastes 11:4 “He who observes the wind will not sow, and he who regards the clouds will not reap.”

If traditional financial planning utilizes some of the same principles, is there really a need for Biblical financial planning?

Worldview Matters

The focus of traditional financial planning is about maximizing the benefit for you and your glory. Biblical financial planning is about maximizing the benefit for God’s glory. The core difference is our worldview. One is focused on ourselves and the other is focused on God.

Over the years I have had the privilege of working with very generous clients who give away more than they could deduct on their taxes in a year. Some of their prior secular advisors recommended they reduce their giving because they didn’t receive any tax benefits from it. The advisor’s worldview was centered on a worldly response to money – what do I get out of it?

Sharing a Biblical worldview with my clients, I understood that they wanted to give as a response to God’s lavish grace expressed in their life, not because of tax benefits. Rather than encourage them to give less, I encouraged them to follow through on what the Lord was leading them to do. The client didn’t need to explain their logic to me, I implicitly understood it.

Our worldview has a profound impact on our decisions in life. When our faith informs our finances, money loses its grip on our lives. A Biblical worldview should impact every area of our finances for the glory of God and not our own selfishness.

The Challenge

When we pursue Biblical financial planning, there are a few areas to be aware of:

- Filters We all have filters in our lives (from our upbringing, our sin etc) that shape the way we see the world and understand the Bible. Sometimes in a good way, but many times it distorts our view, making it hard to clearly see and understand Biblical principles. We reshape principles in a way we think will benefit us, but only further distorts them. Put simply, we have a vision problem.

- Principles vs Rules Rules are easy to understand, but principles require us to think how we will apply them to our lives. If God said you should give 10% of your income, that is fairly easy. Instead, He calls us to be generous and cheerful givers, indicating it is just as much about our heart as it is about the percentage. Being generous and cheerful will look different in your life versus mine. Applying these principles to our lives can lead to pride (look how much I am giving compared to him) and/or legalism (he should be giving the same amount as me). Have we spent the time necessary to consider how to apply these principles to our financial decisions?

- Financial AdvisorsWorking with a financial advisor compounds the above two problems, as each of you have them. However, having an independent person looking at your finances can help identify your blindspots. Do you work with someone who shares your worldview?

Application

There are a few ways to reduce these areas of concern:

- Take time to study God’s Word There is no book of money in the Bible, but spending time to read more about what God has to say on money is a wise use of our time.

- Ask God for wisdom as you enter each decision James 1:5 says “If any of you lacks wisdom, let him ask God, who gives generously to all without reproach, and it will be given him.” God will provide you wisdom, you just need to ask.

- Read personal finance books written from a Biblical worldview This will provide you with different viewpoints to balance as you weigh your own convictions. The best book that I have found on the subject is “Money, Possessions and Eternity” by Randy Alcorn. If you want to challenge your thinking about money, I would strongly encourage you to read it.

- Seek counselConsider periodically meeting with a Christian financial advisor to review your situation. A wise financial advisor will ask the questions to encourage you to come to your own conclusions and convictions, and point out blindspots in your thinking.

The core of Biblical financial planning, is being humble – recognizing that living life via Biblical principles is not black and white. God gives us freedom to make decisions and priorities, but with that freedom comes responsibility. We need to regularly question our convictions and heart motives to ensure that our financial decisions don’t just look right in our lives, but are right.

Final Thought

Someday we will stand before the Lord and give an account for how we managed what He gave us. God has provided us principles to follow and other tools to help us determine our convictions.

Ultimately, we need to be willing to continue to learn and be challenged in our stewardship journey. This is a lifelong process. Allow others to ask you the hard questions because you are not always able to see your blindspots. Take the time to examine them and how they will apply to your life.

Points to Consider

- Are you (and your financial advisor) viewing your finances from the world’s perspective or from a Biblical perspective?

- Money is not the end goal, but a tool to help you achieve your goals.

- Have you done the work to define your convictions on money? When was the last time you reviewed them?

- Are your financial goals centered around your comfort and selfish needs, or focused on God’s glory?